In commercial property, there are few, if any, data more crucial than Gross Leasable Area, or GLA. Gross Leasable Area is a concept that extends beyond mere space. It is a fundamental factor that impacts rental income, property value, and draws tenants to a facility, as well as contributing to long-term growth and investment. Be it shopping centers, retail facilities, offices, or mixed-use, GLA plays a direct role in determining how much rental income can be derived from it. However, rising competition among property investors and developers means that the main aim, going forward, is to maximize rental income derived from effective space management.

This article delves deeper into the effects that Gross Leasable Area has on rental growth, why it has such importance to both investors and tenants, and how optimizing it significantly improves profitability.

What Is Gross Leasable Area?

GLA stands for Gross Leasable Area, which refers to the total amount of floor space in a commercial property that can be leased to tenants for generating rental income. It basically indicates the total floor area within a commercial property that can generate lease revenue by being leased exclusively to the tenant. Gross Leasable Area comprises all the areas accessible exclusively by the lessee, including retail spaces, offices, anchor spaces, restaurants, showroom spaces, kiosks, and others. It does not include common areas not produce any income, which include corridors, lobbies, stairways, elevators, restrooms, mechanical rooms, storage spaces for the operations of the building, and parking spaces.

It basically provides the financial engine for all the commercial property leasing activities because the rental revenue generated by any commercial property is measured on a per-square-foot basis. A greater Gross Leasable Area indicates a greater potential for revenue generation.

Efficiency is also important and, in fact often a greater advantage for some centers where well-conceived floor plans that utilize the land effectively will outperform inefficiently designed and larger centers. To the investor, the developer, and the manager, a clear comprehension of the importance is vital for optimizing tenant mix and rents as well as maximizing occupancy and growth.

Why Gross Leasable Area Is a Key Revenue Indicator?

Gross Leasable Area (GLA) is especially important to note because it is instrumental in determining how much income-producing space is available to let to tenants. Rental space is normally measured per square foot. Therefore, GLA is instrumental in providing a baseline for determining how much space to let. A higher and optimized is therefore instrumental in allowing owners to let space, attract a variety of tenants, and retain higher occupancies. In fact, optimized GLAs not only maximize space but also minimize space waste and enhance space functionality.

As such, owners are able to fetch higher rents and retain positive cash flows. In this regard, Gross Leasable Area is especially important to developers and investors because it provides a measurable and objective determination of a property’s earning capability and growth in value.

Relationship Between Gross Leasable Area and Rental Income

| Factor | Impact on Gross Leasable Area (GLA) | Effect on Rental Income |

| Total Leasable Space | Higher GLA means more units or larger tenant spaces | Increases total rental revenue |

| Rent per Square Foot | It is the base used to calculate rent | Higher GLA × rent rate = higher income |

| Space Efficiency | Optimized layouts reduce wasted areas | Maximizes income without expanding the building |

| Occupancy Rate | Flexible Gross Leasable Area attracts more tenants | Higher occupancy ensures steady cash flow |

| Tenant Mix | Varied Gross Leasable Area sizes support diverse tenants | Reduces income risk and boosts stability |

| Expansion Potential | Additional or reconfigured GLA | Creates new revenue streams |

| Market Demand | Gross Leasable Area aligned with tenant needs | Enables premium rental pricing |

| Net Operating Income (NOI) | Increased GLA raises gross income | Improves property value and ROI |

Higher Gross Leasable Area Means Increased Rental Revenue

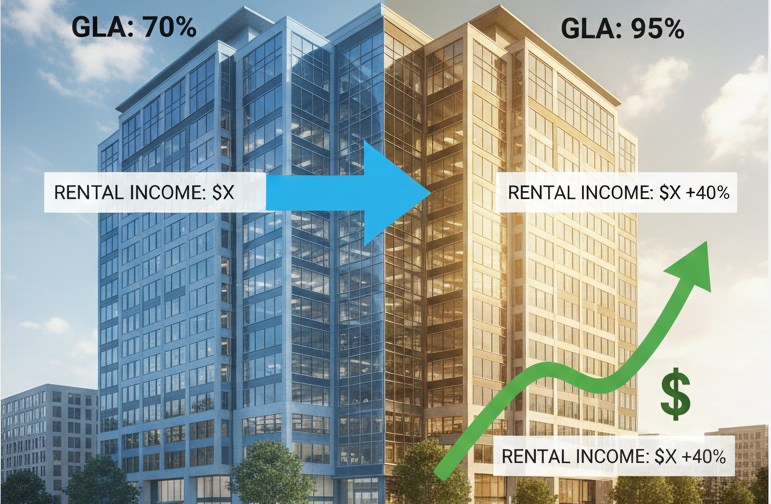

A higher Gross Leasable Area, or GLA, directly translates to higher rental income since it represents income-generating space. The higher the GLA, the higher the capacity to house multiple tenants, upgrade current space, or develop high-end space, all of which translate to higher total rental income. A well-designed GLA not only maximizes space usage but also enables a flexible and dynamic mix of tenants, whose combined absence is minimal, thus providing a constant and positive cash flow. Even a minimal upgrade or configuration change to a Gross Leasable Area can translate to a major positive financial impact, especially if located where tenants are willing to pay premium rentals.

Moreover, optimized GLA properties can earn higher rents per square foot since functional, efficient, and aesthetically pleasing spaces benefit their occupiers. On balance, an increase in GLA involves far more than simply adding additional square footage. It is an optimized strategy that maximizes growth opportunities.

Optimal Gross Leasable Area Improves Tenant Mix and Occupancy

Optimizing Gross Leasable Area is an effective tool for creating a diverse and quality tenant mix, thereby directly impacting occupancy levels and, in turn, revenue. Strategic planning of GLA provides developers with an opportunity to provide leasable units of different sizes, ranging from anchors to small tenants, thereby creating a lively leasing environment.

Higher occupancy ratessimultaneously ensure that a property generates cash flow continuously and positively impacts a property’s competitiveness in a quality manner. Maximization of usable space and reducing waste space, an optimal Gross Leasable Area, converts a commercial property into a dynamic revenue-generating property that consistently delivers results even in a competitive environment.

Impact of Gross Leasable Area on Rental Rate Per Square Foot

Gross Leasable Area has a substantial effect on the rent per square foot, making it an essential component in maximizing the revenue generated from properties. Well-arranged and fully utilized Gross Leasable Area in properties usually attracts high rent due to the enhanced value derived from their space. A larger or fully arranged space gives the tenant more comfort, visibility, and accessibility, which they will be required to pay more to enjoy. Underutilized or ill-arranged space, though large, may hamper the rent, making it lower. Generally, maximizing GLA in properties will enhance their profitability, gain high-quality tenants, and maximize their rent over time.

To Visit Vuzillfotsps – How to Plan Your Perfect Visit

Gross Leasable Area and Property Valuation Growth

The Gross Leasable Area (GLA) is a paramount and value-creating component in the overall valuation appreciation and is thereby one of the most significant factors in the field of commercial real estate investment. The Gross Leasable Area with better optimization in a given property results in better revenue streams, which in turnresults in an increased Net Operating Income (NOI), the most crucial component in the valuation calculation for any property.

Optimizing GLA enables the owner to maximize the rentable area, minimize the non-income-producing areas, and hence maximize the attraction for quality tenants willing to pay top dollars for rentals. The resultant increased revenue and high occupancy levels result in the asset becoming less risky and better-performing, thereby enhancing the capitalization rate.

Additionally, the GLA with scalability is poised for redevelopment, adding to the overall appreciation value for the asset. In competitive markets, Optimal GLA increases not only the current cash value but also the future resale value, confidence, and growth of investment. The real estate is hence marketed as a high-yield and future-ready investment.

Conclusion

Gross Leasable Area is a powerful growth driver in commercial real estate that directly impacts rental income, pricing strength, and long-term property value. When GLA is strategically optimized, it unlocks higher rental rates, stronger occupancy, and sustainable revenue growth. Smart GLA planning reduces wasted space, attracts quality tenants, and positions a property for maximum profitability and future-ready performance in competitive markets.

FAQs

How is Gross Leasable Area different from Gross Building Area?

The Gross Leasable Area will include only the area that can be let out to the tenants and will generate revenue, while the Gross Building Area will include the entire building, including common areas that are not leasable. These include hallways, elevators, and the mechanical rooms.

Can Gross Leasable Area change after a property is already built?

Yes, Gross Leasable Area can be enhanced through renovations, space reconfigurations, mezzanine expansions, and through the strategic utilization of non-core spaces for further leasing, thus contributing significantly to increased income generation.

Does higher Gross Leasable Area always guarantee higher profits?

No. The higher theGross Leasable Area, the greater its earning potential, but the profitability is also subject to other factors like effective layout designs, tenant activity, rental income, and usage. Poor layout designs may impact overall profitability.

Does Gross Leasable Area influence redevelopment and resale potential?

Absolutely. Properties with flexible and expandable Gross Leasable Area are more attractive to buyers and developers, as they offer future redevelopment opportunities and stronger resale value.

Is Gross Leasable Area measured the same way across all commercial properties?

Measurement standards may differ from area to area. Still, for commercial properties, industry standards have been established. These standards enable a level of fairness in renting or appraising the properties.

Pingback: How hhkthk Transform Digital Efficiency by Powerful Workflow